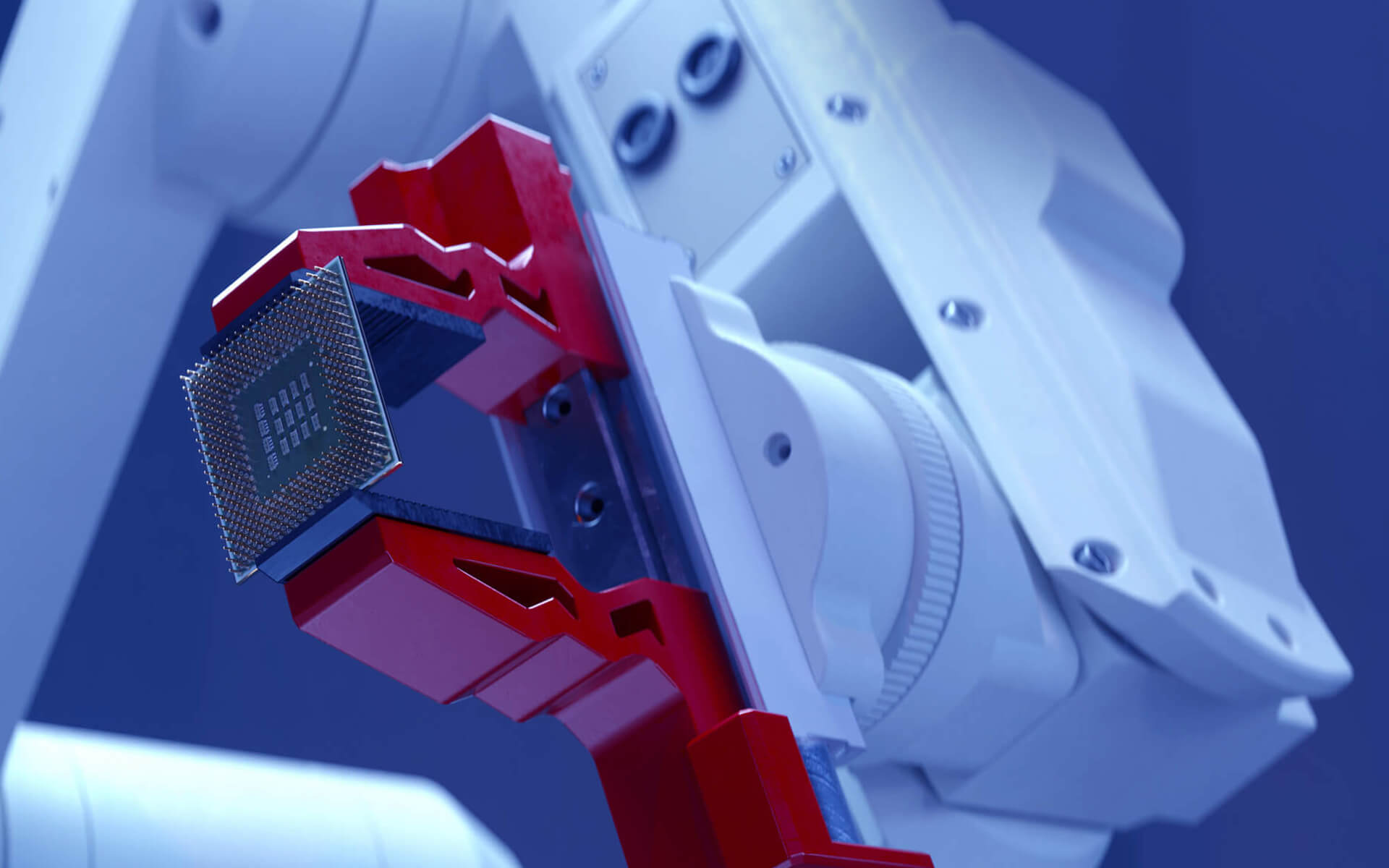

Industrials

We have a proven track record of representing leading businesses in the sector which has given us deep knowledge of the commercial environment. Our advice is pragmatic and informed by our business acumen.

We advise listed companies, family-owned businesses and private-equity backed businesses on some of the most prominent and complex matters in the market. Our comprehensive experience and multidisciplinary approach distinguishes the NKF team and provides clients with results-oriented representation in a wide range of practice areas.

Our industrials team combines expertise from across the firm, in particular from our Capital Markets, Corporate/M&A, Banking, Finance & Regulatory, Antitrust/Competition, Dispute Resolution, Employment, Real Estate, Intellectual Property and Tax teams. Our multidisciplinary approach distinguishes the NKF team and provides clients with solution-oriented comprehensive advice.

Experience:

- Counsel to Landis+Gyr and its shareholders Toshiba/INCJ in the dual track exit process M&A sale and IPO resulting in the CHF 2.3 billion IPO of Landis+Gyr, the largest Swiss and third largest European IPO in 2017

- Counsel to Stadler Rail AG, a leading global pure-play producer of rolling stock and related systems, in connection with its IPO

- Counsel to Klingelnberg AG, a global market leader in developing and manufacturing premium machine tools for bevel gear and cylindrical gear machining and precision measuring centers for gears, in connection with its IPO

- Counsel to ASSA ABLOY AB, the largest global supplier of intelligent door opening solutions listed on Stockholm Stock Exchange, on the indirect acquisition of a 54% controlling interest in agta record ag

- Counsel to Schweiter Technologies on the acquisition of the European acrylic sheet business of Lucite International and the UK distribution company Perspex Distribution Ltd. at an agreed enterprise value for the businesses of GBP 92 million

- Counsel to German private investor group Grünwald Equity on the sale of Luwa Air Engineering AG, a manufacturer of air conditioning systems with a focus on the textile industry, to the Swedish company Nederman Holding AB

- Counsel to Capvis Equity V LP on the acquisition of a majority stake in Variosystems AG, Switzerland, a leading Swiss company active in the field of engineering and manufacturing services for electronic assemblies with facilities in Switzerland, the USA, Sri Lanka and China and customers in end-markets with high requirements such as industrial, medical and aviation

- Advising Eisvogel Group AG, a private industrial holding company on a cross-border transaction leading to the acquisition of a majority stake in Prisma Group s.r.l., a leading Italian designer and manufacturer of industrial automation solutions headquartered in Basaluzzo, Italy

- Counsel to Partners Group/Capvis in the exit deal regarding VAT Group AG (world leader in high tech vacuum valves) resulting in the largest Swiss IPO in 2016

- Transaction counsel on the inaugural CHF 200,000,000 bond offering by VAT Group AG, the leading global developer, manufacturer and supplier of high-end vacuum valves.The bonds will be listed on the SIX Swiss Exchange

- Counsel to TTP AG, an operational holding company specialised in production-related engineering services for the process industry, on the acquisition of the former Pharmaplan company located in Switzerland from the Danish-based NNE A/S

- Counsel to CPH Chemie + Papier Holding AG on the placement of a CHF 100 million corporate bond on the Swiss Capital Market

- Counsel to Zeochem AG, a leading manufacturer of molecular sieves for industrial applications and of chromatography gels for the pharmaceuticals industry, in the acquisition of a majority stake in ALSIO Technology Co. Ltd from the Jiangsu Feixiang Group, domiciled in Lianyungang, China, and in the conclusion of a Joint Venture Agreement with some of the existing shareholders

- Counsel to CITTTIC Group, a group of companies specialised in the acquisition and development of European industrial companies, in the acquisition of Schaltag AG (Switzerland) and Schaltag s.r.o. (Czech Republic) from the Rieter Group

- Counsel to Knorr-Bremse AG, the world’s leading manufacturer of braking systems for rail and commercial vehicles, in the acquisition of Selectron Systems AG, Lyss

- OC Oerlikon Corporation AG in the sale of the Natural Fibers and Textile Components Business Units from its Textile Segment to the Chinese Jinsheng Group

Deals & Cases

01.04.2025

Gurit Holding AG secures CHF 120m financing

Discover More

25.03.2025

Mikron Holding AG secures CHF 100m financing

Discover More

04.03.2025

SIG Group completes bridge financing for upcoming bonds maturity

Discover More